Is Cit Bank an online bank? The question immediately brings to mind the convenience and accessibility of modern banking. Cit Bank offers a robust online platform, but understanding its full capabilities requires exploring its features, security measures, and customer experiences. This examination will delve into the specifics of Cit Bank’s online services, comparing them to traditional banking and other online competitors to provide a comprehensive overview.

We will analyze Cit Bank’s online banking platform, covering account management, transaction capabilities, security protocols, and customer reviews. This in-depth look will help determine whether Cit Bank effectively meets the needs of today’s digitally-savvy consumer seeking a seamless and secure online banking experience. We will also consider the advantages and disadvantages of using Cit Bank’s online platform compared to both traditional banking and other digital banking providers.

Cit Bank’s Online Banking Services

Cit Bank, a prominent online banking institution, offers a comprehensive suite of digital financial services designed for convenience and accessibility. This analysis delves into the features, security, and customer experience associated with Cit Bank’s online platform, comparing it to traditional banking and other major online banking competitors.

Cit Bank’s Online Service Offerings, Is cit bank an online bank

Source: com.sg

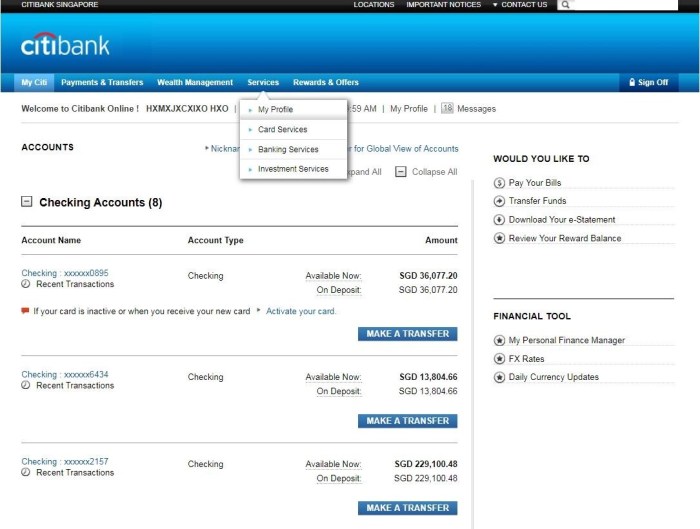

Cit Bank provides a wide array of online banking services, including account opening, funds transfers, bill pay, mobile check deposit, and 24/7 account access. Customers can manage multiple accounts, view transaction history, set up alerts, and access customer support all through the online platform or mobile app.

User Interface and Navigation

Cit Bank’s online platform is designed with user-friendliness in mind. The interface is intuitive and straightforward, featuring a clean layout and clear navigation menus. Users can easily locate the desired functions and manage their accounts efficiently. The mobile app mirrors this simplicity, offering a streamlined experience for on-the-go banking.

Comparison with Other Major Online Banks

Compared to other major online banks like Ally Bank and Capital One 360, Cit Bank offers a competitive range of features. While some features might overlap, subtle differences exist in user interface design, specific service offerings, and customer support approaches. A direct comparison is presented below for a clearer understanding.

| Feature | Cit Bank | Ally Bank | Comparison |

|---|---|---|---|

| Account Types | Checking, Savings, Money Market, CDs | Checking, Savings, Money Market, CDs, IRAs | Ally offers a wider range of account types, including IRAs. |

| Mobile Check Deposit | Yes | Yes | Both offer this convenient feature. |

| Customer Support Availability | 24/7 phone and online support | 24/7 phone and online support | Both provide extensive customer support options. |

| International Wire Transfers | Available | Available | Both offer international wire transfer capabilities. |

Accessibility and Security of Cit Bank’s Online Platform: Is Cit Bank An Online Bank

Cit Bank prioritizes both the security and accessibility of its online banking platform. Robust security measures protect customer data, while accessibility features ensure inclusivity for users with disabilities.

Security Measures

Cit Bank employs multi-factor authentication, encryption protocols, and fraud detection systems to safeguard customer information. Regular security updates and proactive monitoring help mitigate potential threats. The bank also educates customers on best practices for online security to prevent phishing and other scams.

Accessibility Features

Cit Bank’s website and mobile app are designed to comply with accessibility standards, including WCAG guidelines. Features such as screen reader compatibility, keyboard navigation, and adjustable text sizes ensure usability for individuals with visual or motor impairments. The bank actively works to improve accessibility based on user feedback and evolving standards.

Access from Different Devices

Cit Bank’s online services are accessible from various devices, including desktops, laptops, tablets, and smartphones. The responsive design of the website and mobile app ensures optimal viewing and functionality across different screen sizes and operating systems. Customers can seamlessly switch between devices without compromising access to their accounts.

Customer Support for Online Banking Issues

Cit Bank offers multiple channels for customer support related to online banking issues. Customers can contact the bank via phone, email, or through the secure messaging system within the online platform. Comprehensive FAQs and online help resources are also available to address common questions and troubleshoot minor issues.

Account Management and Transaction Capabilities

Cit Bank’s online platform simplifies account management and facilitates various transaction types. The process of opening an account, transferring funds, managing bills, and setting up alerts is streamlined for user convenience.

Online Account Opening

Opening an account with Cit Bank online involves a straightforward process. Customers need to provide necessary personal information, verify their identity, and fund their account. The entire process is typically completed within minutes, subject to verification procedures.

Funds Transfer Methods

Cit Bank offers various methods for transferring funds, including internal transfers between accounts, external transfers to other banks (ACH transfers and wire transfers), and mobile check deposit. These options provide flexibility for managing funds efficiently.

Bill Payment and Recurring Transactions

Cit Bank’s online platform allows customers to manage bill payments and set up recurring transactions easily. Users can add payees, schedule payments, and track payment history. This feature simplifies bill management and reduces the risk of missed payments.

Setting Up Online Alerts and Notifications

To stay informed about account activity, customers can set up online alerts and notifications. These alerts can be customized to notify users about various events, such as low balances, large transactions, and account updates. The setup process is intuitive and requires minimal effort.

- Log in to your Cit Bank online account.

- Navigate to the “Alerts and Notifications” section.

- Select the types of alerts you wish to receive.

- Specify the delivery method (email, SMS).

- Confirm your settings.

Customer Reviews and Experiences

Customer reviews provide valuable insights into the usability and reliability of Cit Bank’s online platform. While generally positive, some recurring issues and complaints have been identified.

Summary of Customer Reviews

Many customers praise Cit Bank’s user-friendly interface, robust security measures, and responsive customer support. The ease of account management and the availability of various transaction options are also frequently highlighted as positive aspects. However, some users have reported occasional technical glitches, slow loading times, and difficulties navigating certain features.

Common Issues and Complaints

Common complaints include occasional website downtime, slow loading speeds, and limited customer service options during peak hours. Some users have also expressed concerns about the clarity of certain fees and charges.

Addressing Customer Feedback

Cit Bank actively monitors customer feedback through online reviews, surveys, and direct communication channels. The bank uses this feedback to identify areas for improvement and to address technical issues promptly. Regular updates and enhancements to the online platform demonstrate the bank’s commitment to improving the customer experience.

Key Aspects of Customer Experience

- Generally positive user experience.

- User-friendly interface and navigation.

- Robust security measures.

- Occasional technical glitches and slow loading times reported.

- Responsive customer support, though occasional delays reported during peak hours.

Comparison with Traditional Brick-and-Mortar Banks

Cit Bank’s online-only model contrasts sharply with traditional brick-and-mortar banks. This comparison highlights the advantages and disadvantages of each approach, focusing on features, fees, and customer service.

Features and Benefits

Cit Bank’s online platform offers 24/7 accessibility, a wider range of services from various locations, and often lower fees compared to traditional banks. Traditional banks, however, provide the benefit of in-person interaction and immediate assistance for complex transactions.

Advantages and Disadvantages

The convenience and accessibility of online banking are major advantages, eliminating the need for physical visits. However, the lack of in-person interaction can be a disadvantage for some customers who prefer face-to-face service. Traditional banks offer in-person support but may have limited hours and higher fees.

Fees and Charges

Cit Bank’s fee structure for online banking services is generally competitive and transparent. Fees vary depending on the services used. Traditional banks may have a more complex fee structure with higher charges for certain transactions.

While CIT Bank offers a robust online banking platform, its services extend far beyond typical digital banking. A significant portion of their business involves CIT Bank commercial lending , demonstrating a multifaceted approach that complements its online accessibility. Therefore, although primarily known for its digital convenience, CIT Bank’s operations showcase a broader financial reach than a purely online-only institution.

Customer Service Approaches

Source: upgradedpoints.com

Cit Bank primarily offers customer support through online channels and phone. Traditional banks offer both in-person and remote support options. The approach to customer service differs based on the bank’s model and customer preferences.

Last Point

Source: bisnismuda.id

In conclusion, Cit Bank presents a compelling online banking option. While the convenience of online access and a range of digital features are undeniable advantages, potential customers should carefully weigh the specific features against their individual needs and compare them to alternative options. A thorough understanding of security measures, customer support availability, and the overall user experience is crucial before making a decision.

Ultimately, the “is Cit Bank an online bank?” question is answered with a resounding “yes,” but the suitability of that “yes” for any given individual hinges on a more nuanced assessment of their banking requirements.