CIT Bank wire transfer instructions: Navigating the world of swift, secure, and efficient fund transfers can feel like charting a course across a boundless ocean. But fear not, intrepid traveler! This guide serves as your compass, leading you through the intricacies of CIT Bank’s wire transfer services, from understanding the different types and associated fees to mastering the art of secure online and phone transactions.

We’ll equip you with the knowledge to confidently execute domestic and international transfers, troubleshoot potential issues, and safeguard your financial information against any unforeseen currents.

Whether you’re a seasoned financial navigator or just setting sail on your first wire transfer journey, this comprehensive guide will illuminate the path, providing step-by-step instructions, insightful tips, and practical solutions to ensure a smooth and successful experience. Prepare to embark on a journey where every detail is meticulously mapped, every potential hazard carefully navigated, and every transaction completed with confidence and precision.

Understanding CIT Bank Wire Transfer Basics: Cit Bank Wire Transfer Instructions

CIT Bank offers various wire transfer options for both domestic and international transactions. Understanding the different types, associated fees, and security measures is crucial for a smooth and secure transfer process. This section details the fundamentals of CIT Bank wire transfers.

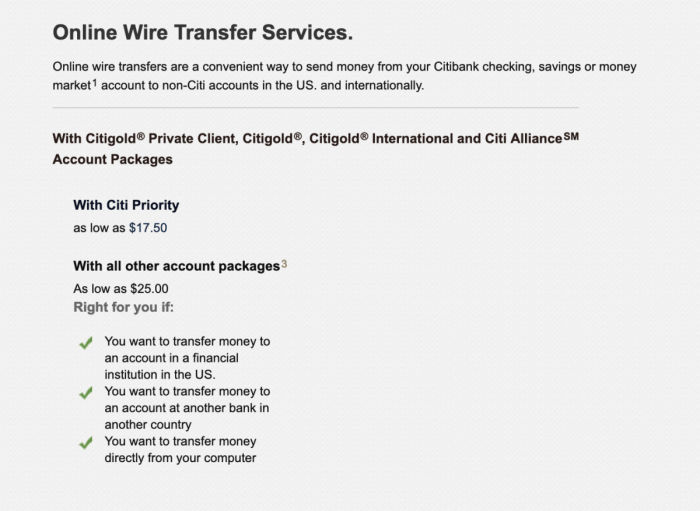

Types of Wire Transfers and Associated Fees

CIT Bank typically offers two main types of wire transfers: domestic and international. Specific fee structures vary depending on the account type, transaction amount, and whether the transfer is initiated online or via phone. It’s recommended to contact CIT Bank directly or check their online banking platform for the most up-to-date fee information. Generally, international wire transfers incur higher fees than domestic transfers due to intermediary bank charges and currency conversion costs.

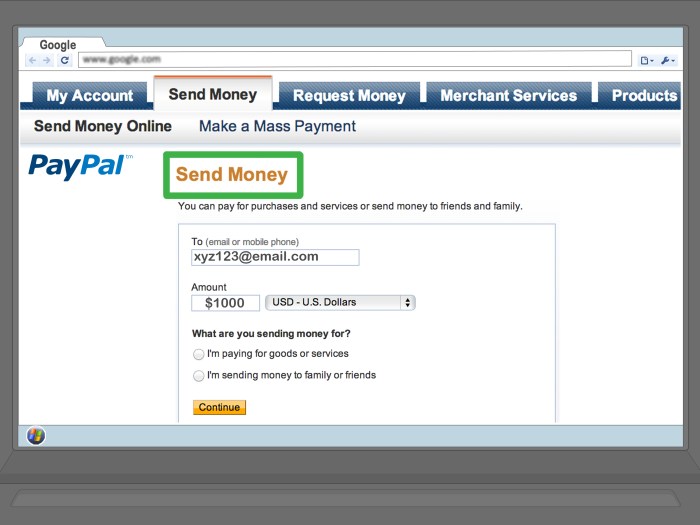

Initiating a Wire Transfer Through CIT Bank’s Online Banking Platform

- Log in to your CIT Bank online banking account.

- Navigate to the “Transfers” or “Wire Transfers” section.

- Select “New Wire Transfer.”

- Choose the recipient type (individual or business).

- Enter the recipient’s banking details (account number, routing number, etc.).

- Specify the transfer amount.

- Review the transaction details and fees.

- Authorize the transfer using your online banking security measures.

Best Practices for Secure Wire Transfer Transactions, Cit bank wire transfer instructions

Security is paramount when conducting wire transfers. Always verify the recipient’s banking details meticulously before initiating the transfer. Use strong passwords and enable multi-factor authentication on your online banking account. Be wary of unsolicited emails or phone calls requesting wire transfer information. Report any suspicious activity to CIT Bank immediately.

Comparison of Domestic and International Wire Transfer Processes

| Feature | Domestic Wire Transfer | International Wire Transfer |

|---|---|---|

| Processing Time | Typically 1-2 business days | Typically 3-5 business days, or longer depending on the destination country |

| Required Information | Recipient’s account number and routing number | Recipient’s account number, routing number, SWIFT code, bank address, and beneficiary’s full name and address |

| Fees | Relatively lower | Significantly higher due to intermediary bank charges and currency conversion |

Preparing for a CIT Bank Wire Transfer

Proper preparation is key to a successful wire transfer. Gathering the necessary information and verifying its accuracy minimizes delays and errors. This section Artikels the steps to take before initiating a transfer.

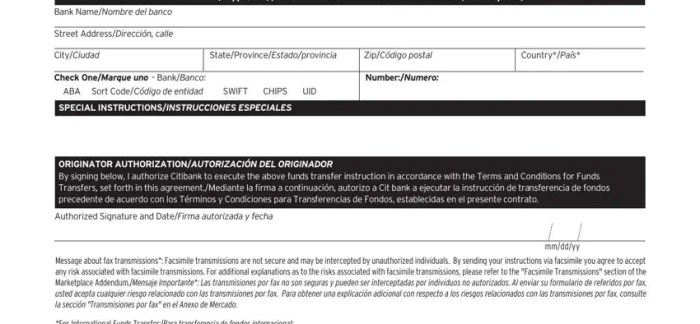

Information Required for Domestic and International Wire Transfers

For domestic wire transfers, you will typically need the recipient’s full name, account number, and the recipient bank’s routing number. For international wire transfers, you will need additional information, including the recipient’s full name and address, the recipient bank’s SWIFT code, bank address, and potentially an intermediary bank’s information. The currency of the transfer must also be specified for international transfers.

Checklist of Documents Needed Before Initiating a Wire Transfer

- Recipient’s full name and address

- Recipient’s bank account number

- Recipient bank’s routing number (domestic) or SWIFT code (international)

- Recipient bank’s address (international)

- Transfer amount

- Your CIT Bank account information

- Valid government-issued identification

Correctly Formatting Beneficiary Information for a Wire Transfer

Accurate formatting is crucial. Ensure the recipient’s name matches exactly as it appears on their bank account. Double-check all numbers and codes for any typos. Use the standard format provided by CIT Bank for international transfers, including SWIFT codes and bank addresses.

Potential Errors That Can Delay or Prevent a Wire Transfer

- Incorrect account numbers

- Incorrect routing or SWIFT codes

- Missing or incomplete beneficiary information

- Insufficient funds in your account

- Typographical errors

Common Issues Encountered During Wire Transfer Preparation

Common issues include incorrect account numbers, missing information, and insufficient funds. Carefully reviewing all details before initiating the transfer can prevent these problems. If you encounter difficulties, contact CIT Bank customer support for assistance.

Executing a CIT Bank Wire Transfer

CIT Bank offers multiple ways to execute a wire transfer, each with its own process and advantages. This section details the steps involved in initiating a wire transfer through both online and phone channels.

Detailed Description of the Online Wire Transfer Process

The online process is generally faster and more convenient. It involves logging into your online banking account, navigating to the wire transfer section, entering recipient details, reviewing the transaction, and authorizing the transfer. Detailed steps are provided in the “Understanding CIT Bank Wire Transfer Basics” section.

Steps Involved in Initiating a Wire Transfer Via Phone

Contacting CIT Bank’s customer service line allows for assistance with more complex transfers or for those who prefer a phone-based approach. Be prepared to provide all the necessary information about the recipient and the transfer amount. The representative will guide you through the process and confirm the details before processing the transfer.

Comparison of Methods for Initiating Wire Transfers (Online vs. Phone)

| Feature | Online | Phone |

|---|---|---|

| Convenience | High | Moderate |

| Speed | Faster | Slower |

| Complexity | Suitable for simple transfers | Suitable for complex or high-value transfers |

Confirmation Process After Submitting a Wire Transfer Request

After submitting a wire transfer request, you’ll typically receive an immediate confirmation within the online banking system. This confirmation will include a reference number which can be used to track the transfer. For phone transfers, the representative will confirm the details and provide a reference number.

Flow Chart Illustrating the Wire Transfer Process

A flowchart would visually depict the steps involved, starting with initiating the transfer request, verifying the details, processing the transfer, and finally receiving confirmation. It would show branching paths for potential issues or delays.

Tracking and Confirming a CIT Bank Wire Transfer

Monitoring the status of your wire transfer and obtaining confirmation is essential. CIT Bank provides tools to track your transfers and receive confirmation receipts. This section explains how to track and confirm your transfers and what to do if there are delays.

Tracking the Status of a Wire Transfer Using CIT Bank’s Online Tools

Source: wikihow.com

CIT Bank’s online banking platform typically provides a section to view the status of pending and completed wire transfers. You can use the reference number provided at the time of initiating the transfer to track its progress.

Information Available in Wire Transfer Confirmation Receipts

Source: payoneer.com

Confirmation receipts usually include the transfer date, reference number, recipient’s details, transfer amount, and the fees charged. They serve as proof of transaction completion.

Examples of Potential Delays and How to Resolve Them

- Incorrect recipient information: Contact CIT Bank immediately to correct the information and re-initiate the transfer.

- Insufficient funds: Deposit sufficient funds into your account.

- Bank processing delays: Contact CIT Bank customer support for updates.

Procedures for Contacting CIT Bank Customer Support

CIT Bank’s website usually provides contact information for customer support, including phone numbers and email addresses. You can contact them for assistance with tracking, confirming, or resolving issues with your wire transfer.

Sample Email to Customer Support Regarding a Delayed Wire Transfer

Source: formspal.com

Subject: Inquiry Regarding Delayed Wire Transfer – Reference Number [Reference Number]

Dear CIT Bank Customer Support,

I am writing to inquire about the status of a wire transfer I initiated on [Date] with reference number [Reference Number]. The transfer has not yet reached the recipient. Could you please provide an update on its status?

Sincerely,

[Your Name]

[Your Account Number]

[Your Phone Number]

[Your Email Address]

Understanding CIT Bank wire transfer instructions is key to smooth, efficient transactions. For alternative payment methods, consider exploring the options available, such as learning more about a CIT Bank cashier’s check by visiting cit bank cashier’s check for a deeper understanding. Returning to wire transfers, remember to always double-check all details before initiating the transfer to ensure accuracy and avoid delays.

Security Considerations for CIT Bank Wire Transfers

Protecting yourself from wire transfer fraud is crucial. This section details best practices and security measures to safeguard your transactions.

Best Practices for Protecting Against Wire Transfer Fraud

Always verify recipient details independently. Never share your banking information via email or phone unless you initiated the contact. Use strong passwords and enable multi-factor authentication. Report any suspicious activity to CIT Bank immediately.

Common Scams Related to Wire Transfers and How to Avoid Them

- Phishing scams: Be wary of emails or messages requesting personal or financial information.

- Impersonation scams: Verify the identity of anyone requesting a wire transfer.

- Fake invoices or requests: Verify the legitimacy of any request before sending funds.

Importance of Verifying Beneficiary Information Before Initiating a Transfer

Verifying beneficiary information is crucial to prevent funds from being sent to the wrong account. Double-check all details against official documents.

Security Measures Implemented by CIT Bank to Protect Wire Transfer Transactions

CIT Bank employs various security measures, including encryption, fraud detection systems, and multi-factor authentication, to protect wire transfer transactions. Specific details on their security measures are typically available on their website.

Tips for Securing Personal and Financial Information Related to Wire Transfers

- Use strong, unique passwords.

- Enable multi-factor authentication.

- Be cautious of phishing emails and scams.

- Verify the identity of anyone requesting a wire transfer.

- Regularly monitor your bank accounts for suspicious activity.

International CIT Bank Wire Transfers

International wire transfers involve additional complexities compared to domestic transfers. This section details the specific requirements and considerations for international transactions.

Specific Requirements for International Wire Transfers

International wire transfers require more information than domestic transfers, including the recipient’s full name and address, the recipient bank’s SWIFT code and address, the intermediary bank’s information (if applicable), and the currency of the transfer. You will also need to consider currency exchange rates.

Comparison of International Wire Transfers with Domestic Wire Transfers

International transfers take longer to process, involve higher fees, and require more information than domestic transfers. The currency exchange rate will also impact the final amount received by the recipient.

Implications of Currency Exchange Rates in International Wire Transfers

Currency exchange rates fluctuate constantly. The exchange rate at the time of the transfer will determine the final amount received by the recipient. CIT Bank typically uses a specific exchange rate at the time of the transfer. It’s advisable to check the current exchange rate before initiating the transfer to estimate the final amount.

Examples of Information Needed for International Transfers (SWIFT Code, etc.)

For example, you’ll need the recipient’s full name and address, their bank’s SWIFT code and address, the transfer amount in the specified currency, and your CIT Bank account information. You may also need the intermediary bank’s details if your bank doesn’t have a direct relationship with the recipient’s bank.

Summary of Key Differences Between Domestic and International Wire Transfer Procedures

| Feature | Domestic | International |

|---|---|---|

| Processing Time | 1-2 business days | 3-5 business days or longer |

| Fees | Lower | Higher |

| Information Required | Account number, routing number | Account number, SWIFT code, bank address, beneficiary details |

| Currency Exchange | Not applicable | Applicable |

Ultimate Conclusion

So, there you have it – a comprehensive voyage through the world of CIT Bank wire transfers. From the initial preparation and execution to tracking, confirmation, and security considerations, we’ve covered the essential aspects of ensuring your financial transactions are not only efficient but also secure. Remember, careful planning and adherence to best practices are key to a successful and stress-free experience.

With this guide as your trusted companion, you’re now well-equipped to navigate the complexities of CIT Bank’s wire transfer system with confidence and ease, ready to chart your financial course with precision and peace of mind.